"In this world, nothing can be said to be certain, except death and taxes."

Whether you live in Spain, or not; rent your whole property out, or just a part - an annexe or holiday flat for example, you must declare your income and pay the due tax. Tax returns cover the financial year running from January 1 to 31 December and they are due by the 30 June deadline of the current year.

The Spanish Tax Office (Agencia Tributaria, also called Hacienda) have stated regularly how important is to include your holiday rental income taxes in your IRPF (Personal Income Tax Declaration) declaration.

There are some deductible costs for residents in Spain and non-residents, such as community fees and the IBI. We recommend you check with your accountant or assessor to clarify what is deductible as a non-resident.

If you are a resident in Spain and rent out a property you must declare your holiday rental earnings on your Spanish tax return (Declaración de la Renta de las Personas Físicas).

Don't make the mistake of not paying your due tax in Spain. The introduction of the new Spanish rentals legislation means that parliament will start to establish ways of checking. This is now the government's biggest focus in cracking down on tax evasion.

In fact, it’s been widely mentioned that they have employed the help of Endesa, to monitor the electricity usage and the utility bills of homeowners; especially those who claim to be out of the country for a good part of the year.

If you are unsure of how to submit your tax return you should visit your nearest tax office for further information or visit the website for the Agencia Tributaria (Tax Office). If your Spanish isn't up to scratch you can employ the services of a Gestoría - a company or individual who can represent you for all bureaucratic and administrative needs - tax, accounts, NIE and residency, etc.

Who has to pay tax on rental income?

EVERY homeowner in Spain must declare their income taxes annually. Even if your property has been empty for a while during the past year you must make a tax declaration following the steps below.

The process to declaring your income taxes is depended if you are considered a resident for tax purposes or not. According to your status, you will submit Form 100 for Residents and Form 210 for Non-residents. If any of the following points apply to your personal situation then you will be considered a resident for tax purposes:

You stayed in Spain 183 natural days or more.

Your main economic activities are based in Spain

Your husband/wife lives in Spain together with their children

How do I do my tax return in Spain?

As we explained above, there are two forms that can be used according to your tax status.

If you are resident for tax purposes, then you will use Form 100 (IRPF) from Hacienda. In case you are not a resident, you must declare your holiday rental income taxes using Form 210. It is mandatory to declare all income you receive in Spain, but don’t panic, if you are a European Economic Area (EEA) citizen you will not pay twice in your country due to the tax treaties between member countries.

Form 100 - IRPF for Residents income taxes

Declaring your income taxes as a resident requires you to submit Form 100, which you can fill online on the Agencia Tributaria platform.

How your holiday rental income is declared all depends on to the economic situation of your holiday rental. You will include your holiday rental income in your IRPF tax declaration as either “Rendimiento por Actividades Economicas” or “Rendimiento por Capital Inmobiliario”

“Rendimiento por Actividades Económicas” (Economic Activity Income)

To summarize, your holiday rental business would be considered an Economic Activity if you match at least one of these considerations:

You, as a homeowner, hire an employee in Spain

You provide hospitality services during the guests stay (i.e. cleaning, breakfast, changing bed clothes, etc)

If one of the previous conditions applies to you, you will have to charge IVA (VAT) to your future guests. IVA must be declared quarterly within the 20 first days of April, July, October and January using Form 303. You can submit this form online through the Agencia Tributaria website. Let’s provide an example:

Mr Smith lives in Malaga, where he owns a holiday rental. He provides daily cleaning services to their guests, thus, he charges 10% IVA. Then he gathers every invoice together with the total amount to declare the IVA every three months.

On the other hand, Mrs Jones owns a holiday rental in Murcia. However, she lives in Palma. Therefore she hired a company to run her holiday rental on her behalf. Mrs Jones offers cleaning services through this company, so she must charge a complimentary 10% IVA that needs to submit quarterly, just like Mr Smith.

Remember that you only have to charge IVA if you offer hospitality services DURING the guest's stay. If you have doubts about the process to follow we encourage you to contact a tax expert.

“Rendimiento por Capital Inmobiliario” (Income arising from residential leasing)

This option is easier (and most commonly used) due to the lack of IVA during the financial operation.

Here you include your holiday rental income to the IRPF declaration (19%). Remember to include the net taxable income for your property if it has been empty for a period during the past year and certain expenses associated with the rental activity can be deducted (such as IBI, insurance, notary, online platform fee’s, etc). Below we will explain how to calculate these.

Once you’ve decided what type of economic situation applies to you

The two options above represent different economic situation for residents. If you are resident in Spain, or an EEA (European Economic Area) citizen, you can deduct your property expenses associated with the rental activity. We go deeper on this issue at the end of this article.

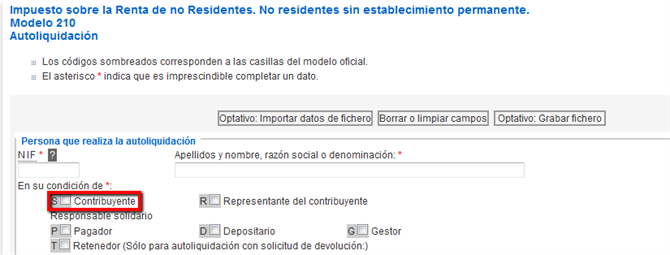

Form 210 - IRNR for Non-resident income taxes (without permanent establishment).

First, you need to access the Hacienda website where you will fill out form 210 following the instructions. There are two options to declare your income taxes:

You can declare it quarterly

OR

You can declare your income taxes every time you receive rental income.

The first option needs to be submitted within the first 20 days of April, July, October and January. Although you can also transfer your money from an overseas bank account, the whole process can be simplified if you have a Spanish bank account.

If the property has been empty during the previous year, then you can submit the form annually.

If you jointly own your property with a spouse, family member or friend, they too will need to declare the earnings and will be taxed accordingly, based on their share of the property.

Residents in Spain and European Economic Area (EEA) citizens pay the same level of taxes on their rental income (19%) whereas Non-EEA citizens pay 24% and cannot deduct expenses associated with rental activity.

It’s important to understand that, even if you are not a tax resident, you must have the identification tax number for foreigners (NIE). If you don’t have one by the time you are submitting this form, you can apply for instantly clicking on “S Contribuyente”.

You can also obtain your NIE at your nearest police office (Policía Nacional). Let’s cover an example:

If Miss Davies, based in London, owns a holiday rental in Lanzarote, she needs to declare her income taxes quarterly using Form 210. Once she fills out the form, she transfers her money using her Spanish bank account to the Agencia Tributaria bank account.

Also, she hired a housekeeper in Lanzarote, Marisa, who cleans the house regularly and manages the check in and checkouts. Considering Miss Davies is providing a cleaning service, she is charging the guest 10% IVA, therefore she must submit, together with her Form 210, the IVA declaration.

What expenses can be deducted?

Agencia Tributaria only needs you to declare your net income (total income minus expenses). Therefore, if you are resident in Spain or EEA citizen, you can include the expenses associated with your rental activity and deduct some of them from your tax declaration.

Some of these expenses can be:

Notary services

IBI

Trash service tax

Power

Water

Property depreciation

Neighbour community fee’s

Online advertising platform fee’s

It’s important to remember that the total amount of expenses must be linked to the month when the property was rented.

Let’s say we had our property rented for three months during the last year. And the total amount for the expenses during the whole year are 12.000€. If we divide this amount by 12, the expenses are 1000€/month. And because we only rented our property for three months, we can only include 3.000€ from the total amount.

For example, if a property was rented for only 3 months during the past year, the total amount of expenses must be divided in twelve (a year) and then consider only three times the amount we obtain from this calculation:

(Total expenses/12) x occupied period (Nºof Months) = Taxable income

On the other hand, you must also declare the amount of time your property was empty. If we continue with the previous example, the property has been empty for 9 months. Let’s calculate how much it would be:

First, you need to obtain 2% (in general) of the cadastral value of your property. If your property value has been checked by Direccion General de Catastro in the past 10 years then you can use 1.1% of the cadastral value instead.

Next, multiply this amount (the value of 2% or 1.1%) by the number of months your property was empty. The result will be the taxable income for this period.