Regulations Affecting the Collaborative Short-term Accommodation Sector in Barcelona

The European Commission has studied the impact of collaborative economy rental accommodation in Barcelona and ten other European cities.

Barcelona is one of the eleven cities that the European Commission has analysed to develop its study on the regulation of tourist rental in the continent. Recently published, the document highlights the "notable economic benefits" that this activity has generated in Barcelona in recent years, while mentioning the protests of residents and the hotel sector for its negative impact on the real estate market and life in the city.

With the title 'Study on regulations affecting the collaborative short-term accommodation sector in the EU', the report aims to examine the effects that this kind of accommodation has on the market.

Here is a summary of the Market Study report on Barcelona and its regulations affecting the collaborative short-term accommodation industry: -

- Impact of the holiday rental industry on Barcelona

- Overview of the long-term rental sector

- Impact on Local Communities

- Future Developments

The report uses data relating to sustained growth of the holiday rental industry in Barcelona during the last decade and predicts a lower development for the future. It predicts that this will be the case for three factors: -

- the City Council's policies to encourage the supply of long-term rentals over the short term and the tourist lease,

- the displacement of the collaborative economy to the periphery of the city, and

- the "growing cooperation" between marketing leasing platforms and political leaders to combat the illegal offer.

Also, it foresees that the action of the autonomic government to reduce the "regulatory uncertainty" on the collaborative economy.

Impact of the holiday rental industry in Barcelona city

The study shows that Barcelona City Council received 2,750 complaints from its residents in 2016 regarding holiday rental activity, with complaints of illegal offerings, noise and problems of public order. It also cites the impact on the provision of public services, although with this regard, there is very little data.

The report of the European Commission also refers to the "changes in the real estate market" caused by tourist rental. Despite the current moratorium (suspension of issuing holiday rental licences since 2017) decreed by the Barcelona City Council the number of properties offered through some holiday rental portals has increased.

Note: Spain-Holiday.com only offers properties that are 100% legally registered for holiday rentals in Barcelona.

TABLE 1: OVERVIEW OF RENTAL ACCOMMODATION IN BARCELONA

No. | Indicators | Categories | Value |

A1

| Average market rental price for long-term rentals per month (2016) | One bedroom | €714.54 |

| Two or three bedrooms | €1,150.16 | |

Average market rental prices for short-term rentals per month (2016) | Studio/one bedroom property | €1,003 | |

| Two or three bedroom property | €3,593 | |

| All listing categories | €2,555 | |

|

| Hotel room | €3,802 |

| Rooms or residences | Rooms | 8,405 |

A2 | Available for short-term rental | Entire primary and secondary residences or touristic houses | 23,493 |

A3 | No. of available residences (housing stock) | 675,280 | |

A4 | No. of available properties for long-term rental (vacant dwellings) | 88,259 | |

A5 | No. of available properties offered through collaborative short-term rental platforms | 49,175 | |

A6 |

Short-term occupancy rate | For short-term rentals | 59% |

For hotel rooms | 80.7% | ||

No. of nights peer providers rent out their property (median) | 95/year | ||

A7 |

Average length of stay | For short-term rentals | 4.2 nights |

For hotels or conventional accommodation providers |

2.5 nights | ||

A8 | Income gained through short- term rental activities | Short-term rental providers | €6,984

|

Hotels or conventional accommodation providers | €12,540 | ||

The tourism accommodation sector in Barcelona is subject to both regional and city-level rules. While the Catalonian Government sets minimum requirements, the Barcelona City Council can go beyond them and implement stricter rules.

At regional level, the Catalan Tourist Act (2002) sets the rules applicable to short- term rentals. The amended decree (2012) has introduced the concept of “homes for tourist use”, defined as private properties that are regularly rented out by their owners, directly or indirectly, to tourists on a seasonal basis. Only those short-term rentals which are offered at "homes for tourist use" are regulated and these need to be rented out in their entirety.

On the other hand, sharing rooms in primary residences is not regulated. Homes for touristic use for stays of less than 31 days must comply with the following holiday rental regulations in place in Catalonia: -

- Register in the Tourism Register of the Catalan Tourist Office;

- Apply for a tourism licence;

- Comply with health and safety laws;

- Display the tourism licence reference number on all marketing;

- Be furnished;

- Issue invoices with VAT (IVA);

- Charge tourist tax;

- Inform the police of all stays within 24 hours of arrival;

- Provide a contact number in case of problem and make available a complaint form.

In addition to those requirements, it not allowed to rent out just rooms, which means that homeowners may not live in the property (and thus can only rent out their secondary residence, i.e. a residence which does not constitute their usual residence).

The Catalan Government is preparing a decree allowing homeowners to rent apartment rooms under the following conditions:

- They live in the apartment before and during the rental period;

- Rentals cannot last more than 31 days, and rooms can only be available for a maximum period of four months a year (non-consecutive);

- Maximum of two rooms per apartment to be rented out;

- Municipalities determine in which city areas this home sharing activity can take place;

- Owners/rental managers are responsible for collecting a tourism tax (From €0.65 in Barcelona and €0.45 in the rest of Catalonia.)

In cases where homeowners only rent two rooms per apartment, the decree does not require them to register their property in the Tourism Register and to have a tourism license. The decree is expected to yet to be finalised.

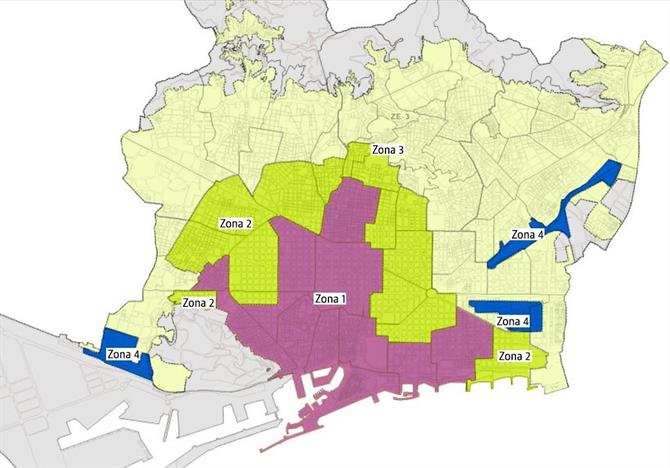

At city-level, the Barcelona City Council has put some restrictions on the short-term rental market. The 2017 Special Plan on Tourism Accommodation created tourist zones according to the level of saturation of tourists, with different replacement/swapping rules:

- In Zone 1, where the most popular tourist neighbourhoods are located, new touristic establishments are not allowed and will not be replaced in case they cease their activity. A decrease of the number of licenses for homes for tourist use in this area can enable to have new licenses in Zone 3.

- In Zone 2, new touristic establishments are also not allowed, but can be replaced provided they furnish the same number of beds. A decrease of the number of licenses for homes for tourist use in this area can enable to have new licenses in Zones 2 and 3.

- In Zone 3, new touristic establishments are permitted to open and expand current ones under specific circumstances. A decrease of the number of licenses for homes for tourist use in this area, as well as Zone 1 and 2, can enable to have new licenses in Zone 3.

- In Zone 4, the number of touristic establishments is limited, and the establishment of homes for tourist use is not allowed.

Special Plan on Tourism Accommodation, division by zones

Over the summer 2016, the City Council launched website and a hotline to encourage residents to report illegal rental of properties to tourists. A team of 20 inspectors (increased to 40 in June 2017), has been mobilised to check the properties reported.

According to a press release by the City Council in September 2016, it has issued removal orders against 615 illegal flats during July and August 2016 and opened a total of 1,290 cases. In case of non-compliance with the law, fines of up to €600,000.

Snapshot of the long-term rental market in Barcelona (compared to other major European cities)

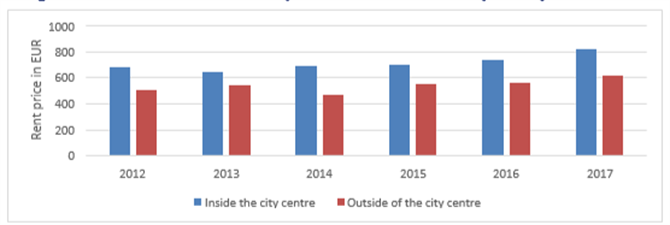

Barcelona is the most expensive Spanish city in terms of long-term rent prices, and short- and long-term rental market prices have considerably increased over the past ten years.

In 2016, the average market price for long-term rentals was €801.70 (See Table 2 below). Data from the Catalonia Statistics Institute (Idescat) shows that rents have increased by 18% in the last three years.

TABLE 2: Long-term rent of one bed-room apartments in Barcelona (in EUR)

TABLE 3: Average monthly rents for long-term rentals in 2016

Categories | Average monthly rent (EUR) |

One bedroom | €714.54 |

Two and three bedrooms | €1,150.16 |

Overview of number of available properties

According to the Barcelona City Council, the situation of the housing market in Barcelona is difficult. Rising rents have made it expensive for residents to stay in the city centre, displacing population towards the outskirts. To counter this phenomenon, the urbanistic plan of Barcelona prohibits the building of new hotels in the city centre and also limits the number of licences granted to homes for tourist use.

In Table 4 below, the number of registered residences (housing stock) in Barcelona is given for the years 2012-2015 from EUROSTAT.

With regards to the number of available properties for short-term rental in Barcelona, the City Council of Barcelona estimates: –

- 14,857 homes for tourist use

o 9,600 registered (legal) homes for tourist use;

o 5,257 non-registered (illegal) homes for tourist use.

o Among those properties, the City Council estimates that 8,405 rooms are available for short-term rental in the city of Barcelona.

- 408 hotels

o Offering 34,872 hotel rooms, i.e. 64,640 hotel beds.

In 2016, there were 9,600 registered residences “homes for tourist use” in the Catalan Tourist Register. Since 2010, when the register was established, a number of residences quadrupled. As of 2015, new residences can no longer register, and the 2017 Special Plan on Tourism Accommodation establishes different replacement/swapping rules by zone.

TABLE 4: Evolution of the number of registered “home for tourist use”

Year | Number of registered homes for tourist use |

2010 | 2,349 |

2011 | 2,580 |

2012 | 4,730 |

2013 | 7,044 |

2014 | 9,606 |

2015 | 9,606 |

In 2011, there were 88,259 available properties for long- and short-term rental (vacant dwellings in Barcelona).

Out of the 811,520 dwellings recorded in the latest official census from the Catalan Institute of Statistics: -

- 84.3% were primary residences;

- 4.8% secondary residences;

- 10.9% were vacant.

In addition, in 2011 there were 205,912 primary residences rented out (as opposed to residence owned) in Barcelona. No distinction was made between proportion of residences rented out on short or long-term basis.

According to Barcelona City Council data, the short-term rental market therefore represents 7.7% of the private housing stock rented out.

As noted in the Barcelona City Council study (2016), the percentage of private housing stock that is rented out in the short-term market increases to more than 10%, and in some cases as much as 25% and above, in the following neighbourhoods: -

- Dreta del Eixample (27%);

- Vila Olímpica (25.8%);

- Sagrada Família (15.9%);

- Poble-Sec (15.2%);

- Diagonal Mar (15%);

- Antiga Esquerra de l’Eixample (14,8%);

- Poblenou (14.4%);

- Sant Antoni (13.7%);

- Gràcia (11.9%);

- Sant Pere (11.8%);

- Fort Pienc (11.6%);

- Hostafrancs (11.6%).

TABLE 5: Summary overview of number of available properties – Barcelona

No. | Indicators | Number |

A1 | Number of rooms (Barcelona City Council) | 8,405

|

| ||

Number of entire primary and secondary residences (incl. investment flats) (sum of platforms) | 23,493 | |

Number of available properties for short-term rental (Barcelona City Council) | 14,857 | |

Number of available properties for short-term rental (sum of platforms) | 39,957 | |

A2 | Number of registered residences (Barcelona City Council) | 9,600 |

A3 | Number of available residences (housing stock) | 675,780 |

A4 | Number of available properties for long and short-term rental (number of vacant dwellings) | 88,259 |

A5 | Number of available rooms/properties offered through online means (sum of platforms) | 49,175 |

Despite the increased popularity for tourists of the short-term rental market over traditional accommodation, tourists in Barcelona still choose to stay in hotels as their first option.

In 2016, Barcelona hotels have received 9.1 million tourists, which is an increase of 9.2% compared to the previous year. Hotel occupancy has increased by 7.5% since 2011, which can be explained as the supply of available beds in hotels has increased slower than the demand for overnight stays in the city (since 2015 it is forbidden to build hotels in the city centre, whereas the number of tourists visiting the city has constantly increased).

Data from PwC (2016) shows that between 2014 and 2015, the average day rate for hotels has also increased by 6.2%.

It can be concluded that the growth in the number of tourists in Barcelona has also had a positive impact on the hotel sector.

Impact on local communities

This section describes positive and negative implications of the collaborative economy accommodation offer on local communities.

Development of ancillary services

Barcelona, and the region of Catalonia, are key drivers of the Spanish economy. The tourism sector is an important economic driver for the city of Barcelona. In 2016, the tourism and hospitality industry represented 90,555 workstations (enterprises and people employed) accounting for 8.8% of the total city employment.

One of the ways in which collaborative economy tourism contributes to local economic development can be through increased spending on local businesses.

Barcelona City Council, in a report dated from 2015, estimates that Barcelona tourists staying overnight in self-catering accommodation spend an average of €99 per day, compared to €78 for those staying on all types of accommodation.

Housing supply changes

The number of short-term rental properties has increased in the past few years.

According to a recent study by the City Council shows that out of 73 neighbourhoods, the short-term accommodation offer is concentrated in ten neighbourhoods located in the most central two districts: -

- Ciutat Vella

- Eixample.

The neighbourhoods with the greatest number of short- term rental offers are: -

- Dreta del Eixample with 2,294 homes for tourist use (legal or illegal), which represents 14% of the total Barcelona supply.

- The neighbourhoods of Gràcia, Sagrada Família, Antiga Esquerra de l’Eixample with in excess of 1,000 homes for tourist use in each neighbourhood.

According to the Barcelona City Council, this concentration in the accommodation offer has led to important changes in the housing supply.

The conversion of available properties into hotels and short-term rental units has led to a rise in rental prices that, along with some negative externalities for residents, contribute to the displacement of local population outside the city centre. For example, since 2007 the district of Ciutat Vella and Barri Gotic has lost 11% and 45% of its population respectively.

The City Council of Barcelona has taken measures to increase the long-term housing supply in those areas. Also, the spread of collaborative economy listings outside the city centre could help to deconcentrate the short-term rental offer outside the city centre.

Local residents’ perception of collaborative short-term rental platforms

There are diverging views regarding the benefits and drawbacks of collaborative short-term rental platforms in Barcelona.

Renting short-term through holiday rental platforms can increase revenues and the flow of tourists also induces positive impacts for the local economy.

An opinion survey in 2015 conducted on Barcelona residents showed that, overall, more than 91.5% believed that tourism was beneficial for the city although in central areas such as Ciutat Vella and Gràcia, this figure drops to 11.7% and 15% respectively.

According to the 2015 survey conducted by the City Council, 43% of Barcelona residents (61.6% in Ciutat Vella) considered tourism to be reaching its limits in terms of the city’s capacity to provide services for tourists. The demand for reduction of tourism has been initiated by neighbourhood associations and social movements, and ever since it has been the reason for demonstrations in the city.

In 2016, the City Council has received about 2,750 complaints from Barcelona inhabitants that concerned homes for tourist use. According to the Barcelona City Council, these complaints related to the denunciation of illegal rentals, but also covered noise or disorder problems.

Impact on public services

There is very limited data available on the impact of the collaborative economy accommodation offer on public services. The City Council of Barcelona has detected a crowdedness of public transport in touristic areas (for instance, in the metro stations near tourist monuments such as Sagrada Familia or Park Güell).

Future developments

The collaborative economy in the tourism accommodation sector is growing in Barcelona as well as other cities and popular beach destinations in Spain. For this reason, is increasingly under the focus of policy makers in Europe and beyond, who are looking at workable solutions.

Despite noticeable economic benefits, the negative impact on the housing supply and local residents has been stressed by residents and hospitality industry associations.

Several factors could nevertheless slow this phenomenon in the future: -

1. Policies taken by the City Council of Barcelona encouraging long-term accommodation offer over short-term and tourist rentals.

2. Collaborative economy increases the accommodation offer in peripheral areas moving tourism traffic from already crowded city centre and contributing to more balance spread of tourists in the city.

3. A growing dialogue between platforms and policy makers, as shown by the collaboration of holiday rental platforms regarding illegal listings.

In 2015, the Government of Catalonia created an interdepartmental commission for the study of the collaborative economy focusing on several themes (i.e. accommodation, consumer issues, taxation, etc) with the aim of reducing regulatory uncertainty around the collaborative economy.

Full report available to download directly from the European Commission.